South Africa's white maize price surge

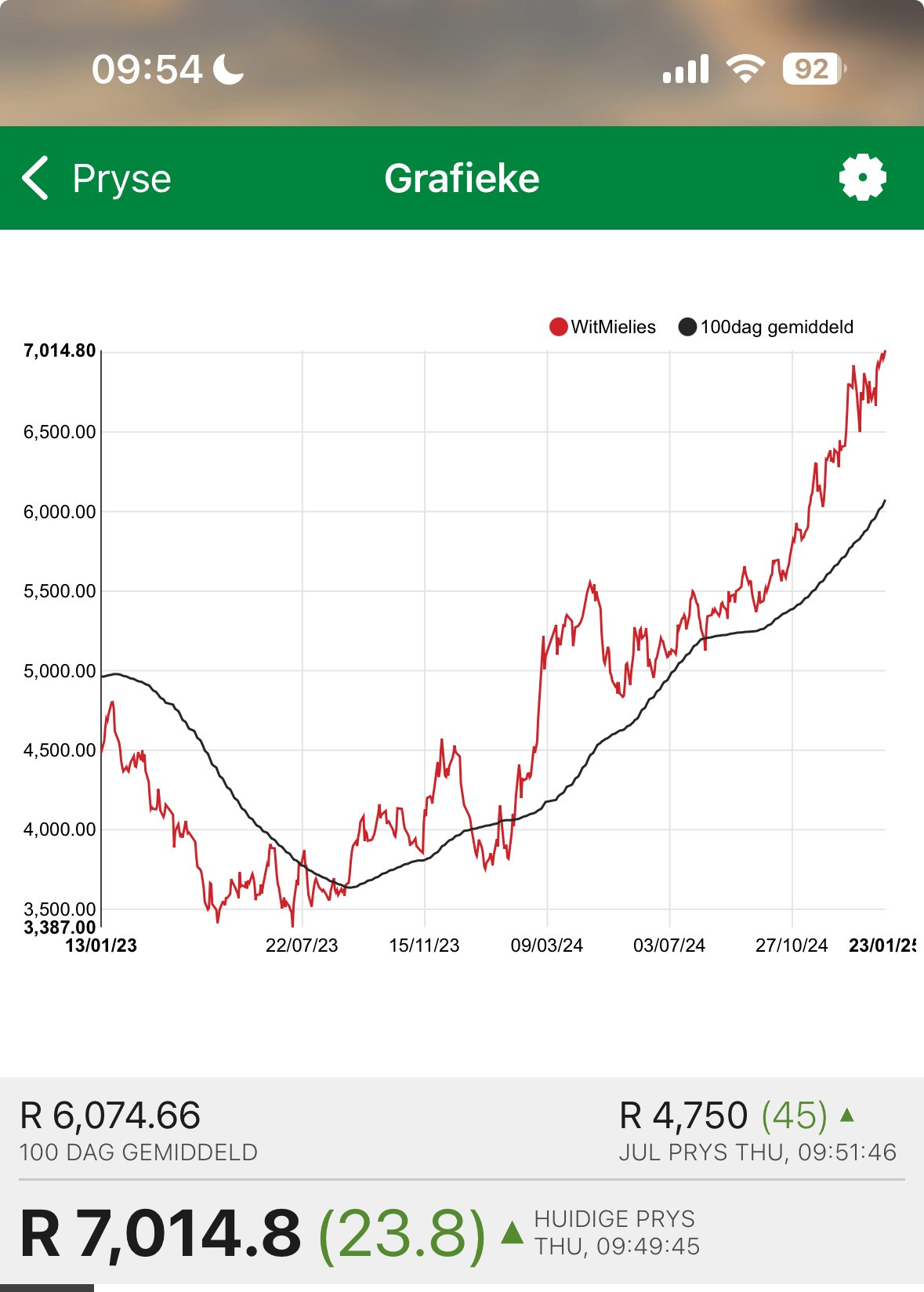

The high for today thus far is R7,020 per tonne and low R6,920.

I am coming to your inbox again this morning because I noticed that South African white maize prices had crossed the R7,000 per tonne mark earlier in the day. At the time of writing this post, they had retreated to just under R7,000 per tonne.

But I want to underscore a few things I have discussed here before: white maize prices will likely be elevated for much of the first quarter of the year.

Ordinarily, prices would soften somewhat when the production estimates for a new season are favourable. But I suspect we may not see such a thing this year even if the production estimates come out promising when the Crop Estimates Committee releases them at the end of February.

We will have just the planting data at the end of this month. The reason for a likely higher maize price Is because of several reasons:

South Africa's maize harvest fell by 23% to 12.7 million tonnes. About 6.0 million tonnes are white maize, and 6.7 million tonnes are yellow maize. The overall maize harvest of 12.7 million tonnes is slightly above the annual consumption of 11.7 million tonnes.

The Southern Africa region had a poor harvest and now looks to South Africa for supplies, adding more upside pressure on prices. Zambia lost half of its maize crop, Zimbabwe lost nearly two-thirds of its maize, and other countries experienced significant losses.

South Africa's maize harvest (12.7 million tonnes) in the 2023-24 production season, combined with the large carryover stock from the previous season (about 2.4 million tonnes), placed the country in a relatively comfortable position regarding maize supplies—at least for a moment. Of the previous season's 2.4 million tonnes of carryover stock, about 1.3 million tonnes were white maize, and 1.1 million tonnes were yellow maize.

Combining the white maize carryover stock with the white maize harvest for the season meant South Africa had just over 7.0 million tonnes of white maize supplies in the 2024-25 marketing year. With the local white maize demand set to decline to about 5.2 million tonnes, I viewed South Africa as better placed to continue exporting to neighbouring countries. And we continued to export. Between May 2024 and the first week of January 2025, white maize exports were 1.06 million tonnes.

But this is beginning to bite, and South Africa's white maize stocks are "super tight" when we have accounted for exports and domestic needs, which explains the price increase.

We hope the 2024-25 maize harvest may be decent and help ease the price increase in the coming months. But the deliveries may be slow, as some areas are planted late. Hence, I believe it is possible that South African white maize prices could remain high for much of the first quarter.

This means consumers can expect the prices of grain-related food products to be adjusted to accommodate these increases in raw materials (maize).

To be clear, I am not arguing for any policy change regarding exports; the post is mainly an update on what the hell is going on with these prices.